Property Tax Los Angeles Covid

Current year is available between october 1 and june 30 only.

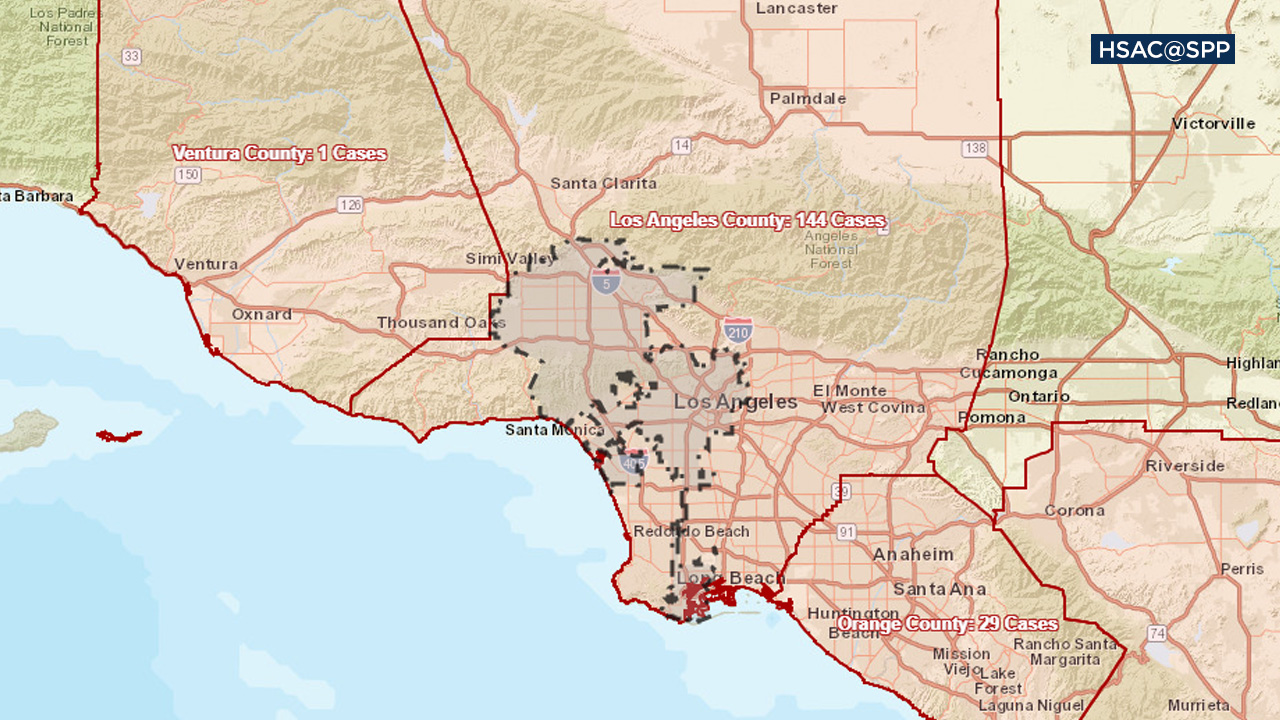

Property tax los angeles covid. Los angeles county tax collector kenneth hahn hall of administration 225 north hill street room 137 los angeles ca 90012. What covid 19 means for your property taxes. 2020 04 9 110000 2020 04 9 123000 americalosangeles property taxes business climate in a covid 19 world.

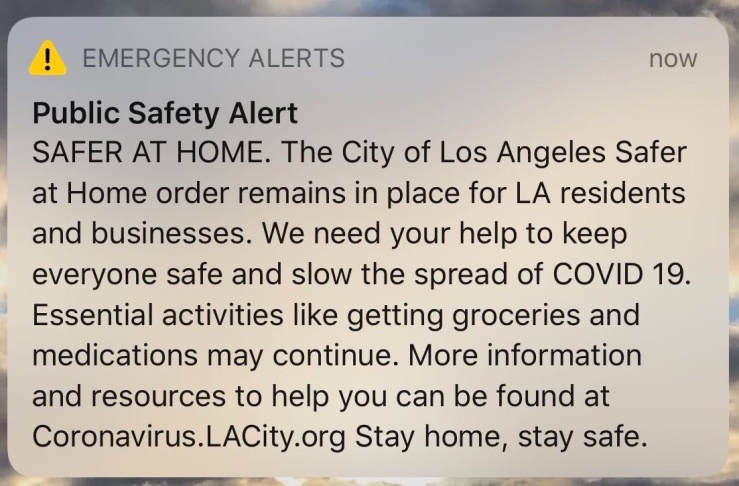

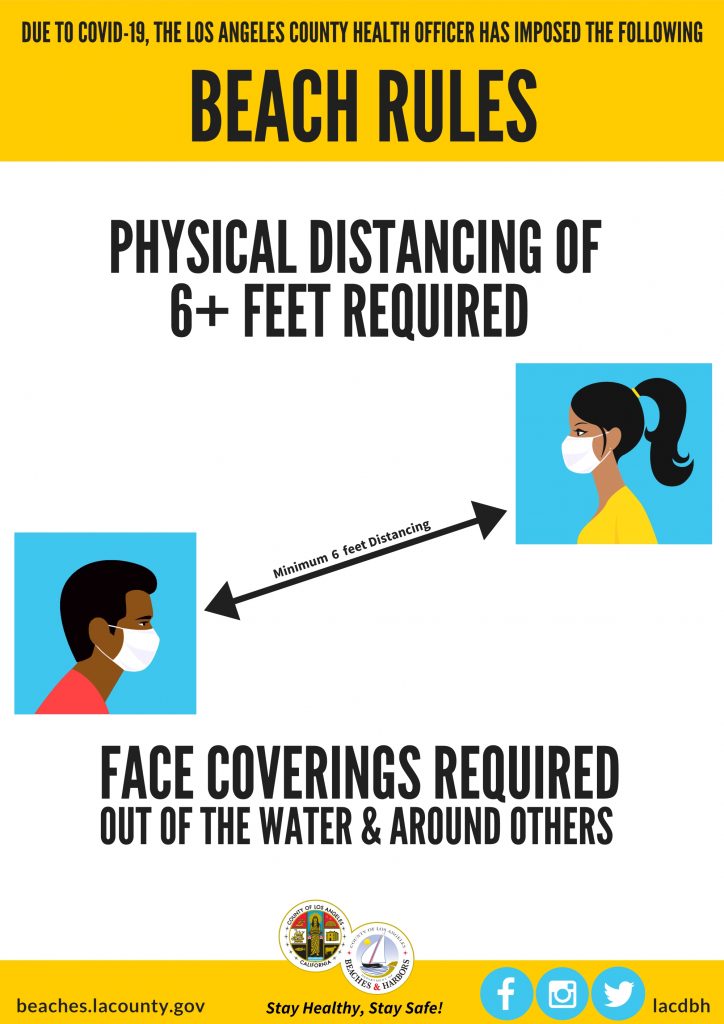

This virtual town hall will help to clear up confusion for property and business owners. Los angeles county covid 19 rental relief program the la county covid 19 rent relief application will open on august 17 2020 for income eligible renters in los angeles county. Watch this psa to learn more about how you can apply for assistance.

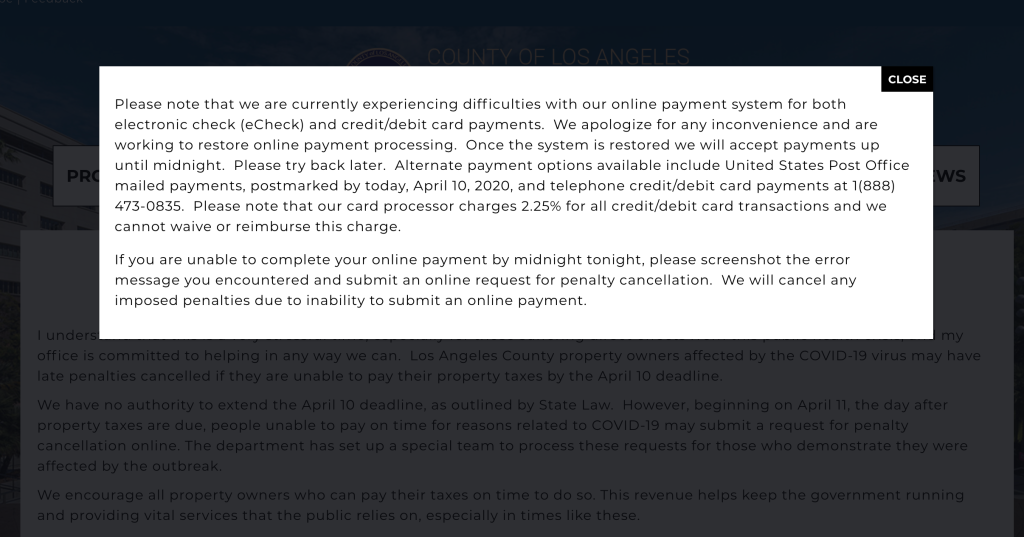

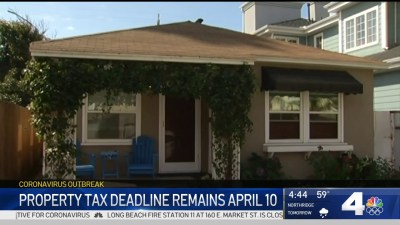

While state law does not provide the authority to extend the april 10 deadline beginning on april 11 the day after property taxes are due people unable to pay on time for reasons related to covid 19 may submit a request for penalty cancellation online. Starting april 11 los angeles county property owners can submit a request for penalty cancellation if they are unable to pay their property taxes on time because of covid 19 treasurer and tax. Antonio vazquez chairman state board of equalization hon.

Prepared by the county of los angeles tax collector march 18 2020 page 2. We understand that this is a very stressful time especially for those suffering direct effects from this public health crisis and the treasure and tax collectors office is committed to helping in any way they can. Property tax amounts are established on the lien date of january 1 of each year.

Senator ben allen california state senate. Los angeles county property owners affected by the covid 19 virus may have late penalties cancelled if they are unable to pay their property taxes by the april 10 deadline. Assessor auditor controller treasurer and tax collector and assessment appeals board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in los angeles county.

The property tax amounts currently due for the 2019 2020 annual secured. This website provides current year and delinquent secured tax information. Participants in the town hall include.

Property owners affected by the covid 19 public health crisis must complete and submit a penalty cancellation request online and include a brief statement of how the public health emergency has impacted their ability. To locate the amount of your secured property taxes click the following link how much are my property taxes.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19862425/ComingAttractions_Close_3.jpg)