Los Angeles Sales Tax Calculator

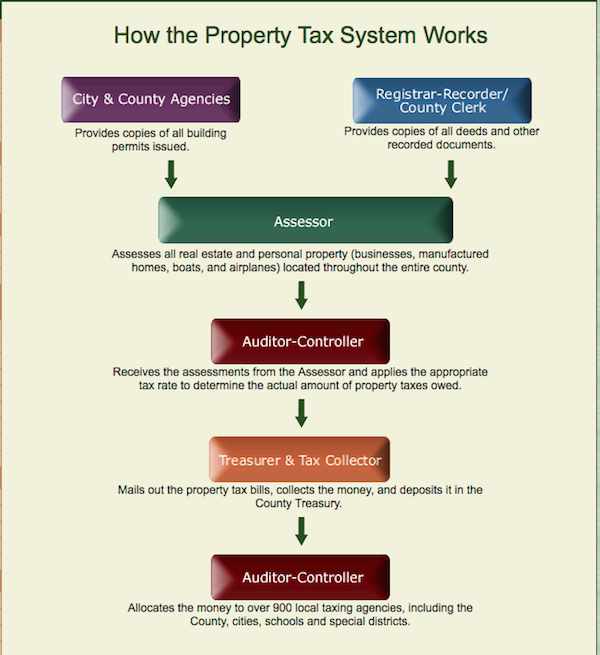

Supplemental tax estimator estimate taxes for a recently purchased property.

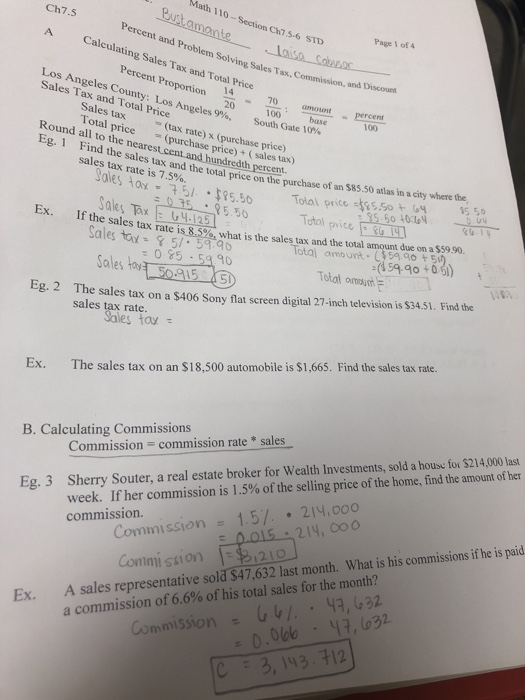

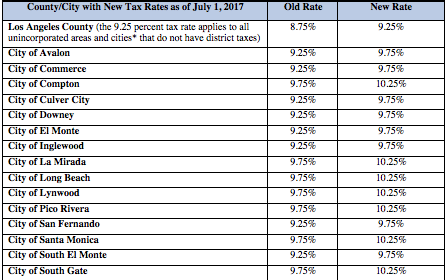

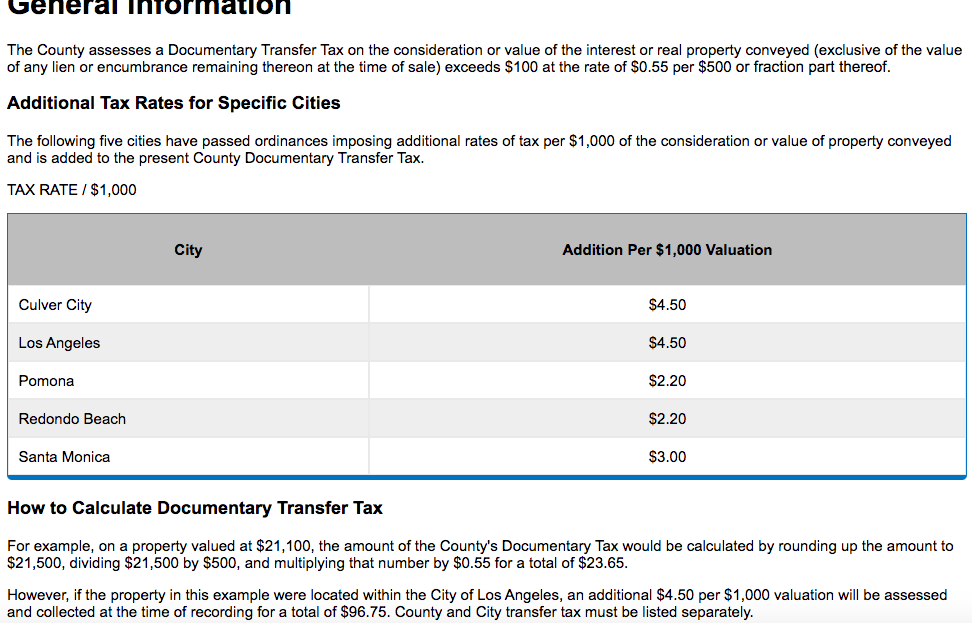

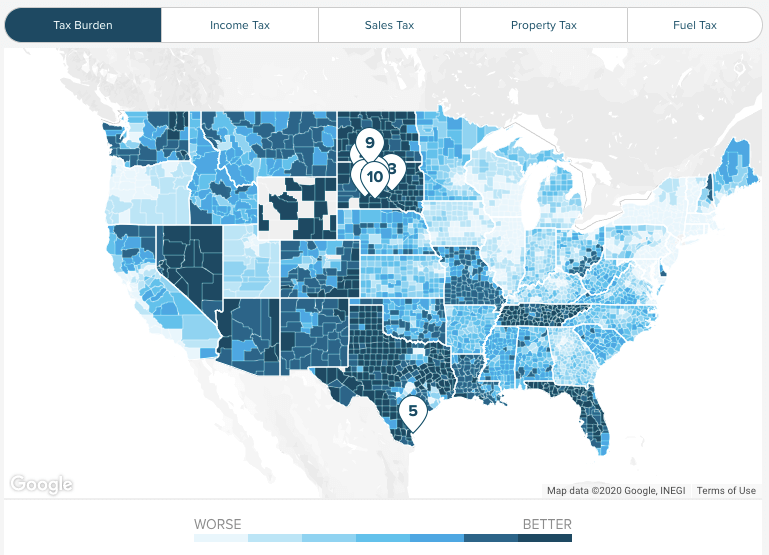

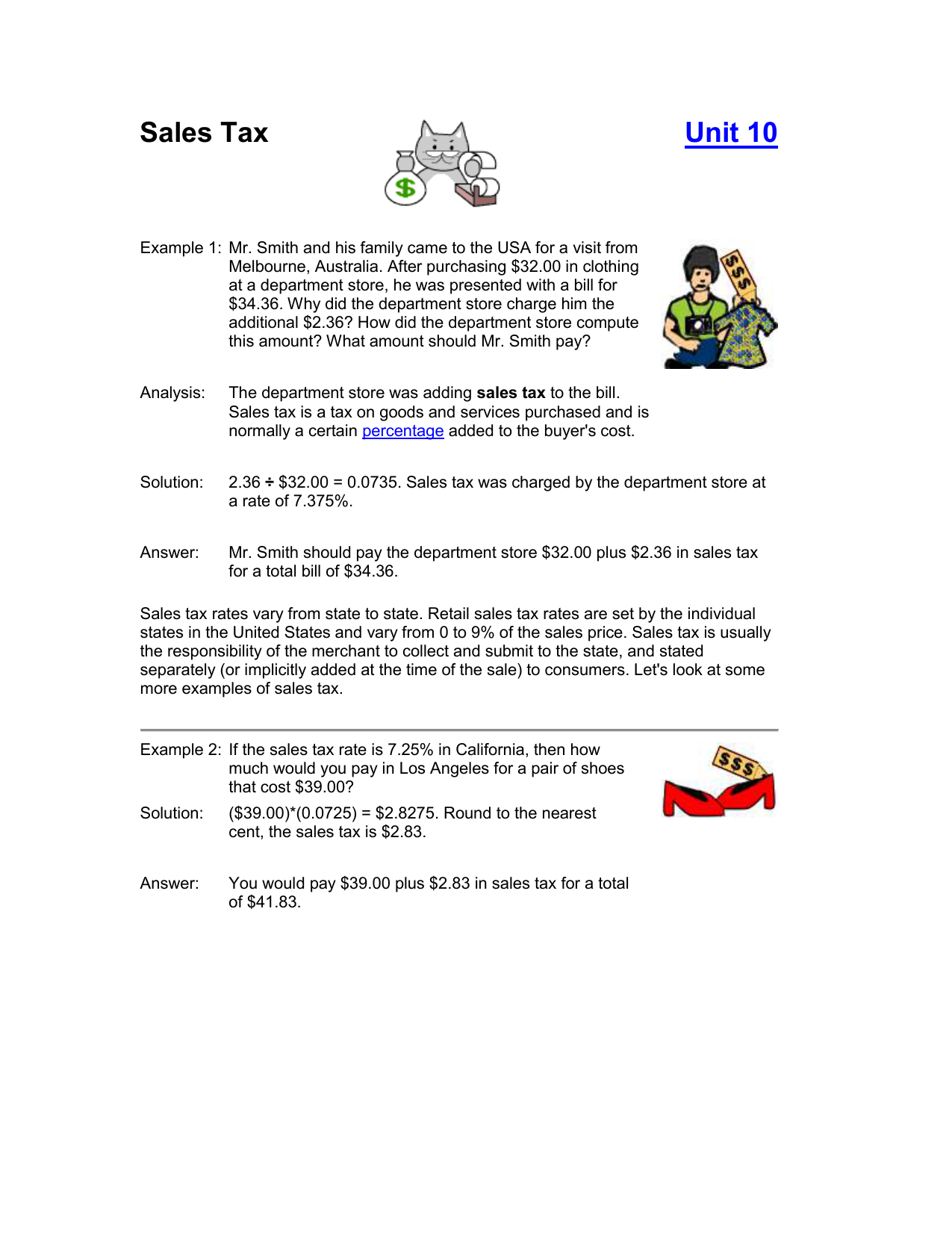

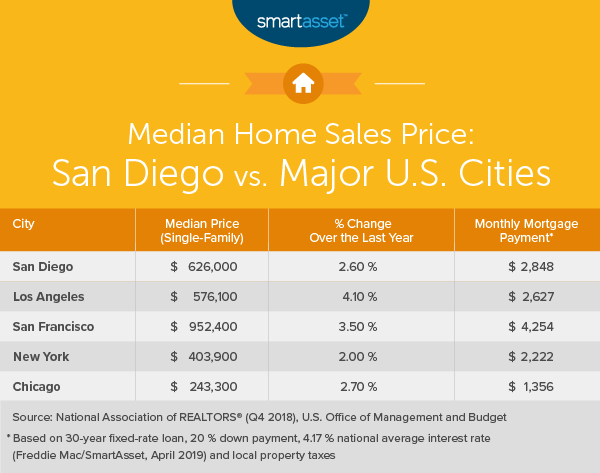

Los angeles sales tax calculator. Depending on the zipcode the sales tax rate of los angeles may vary from 65 to 10 every 2020 combined rates mentioned above are the results of californiastate rate 6 the county rate 025 the los angeles tax rate 0 to 05 and in some case special rate 325. The california sales tax rate is currently 6. This is the total of state county and city sales tax rates.

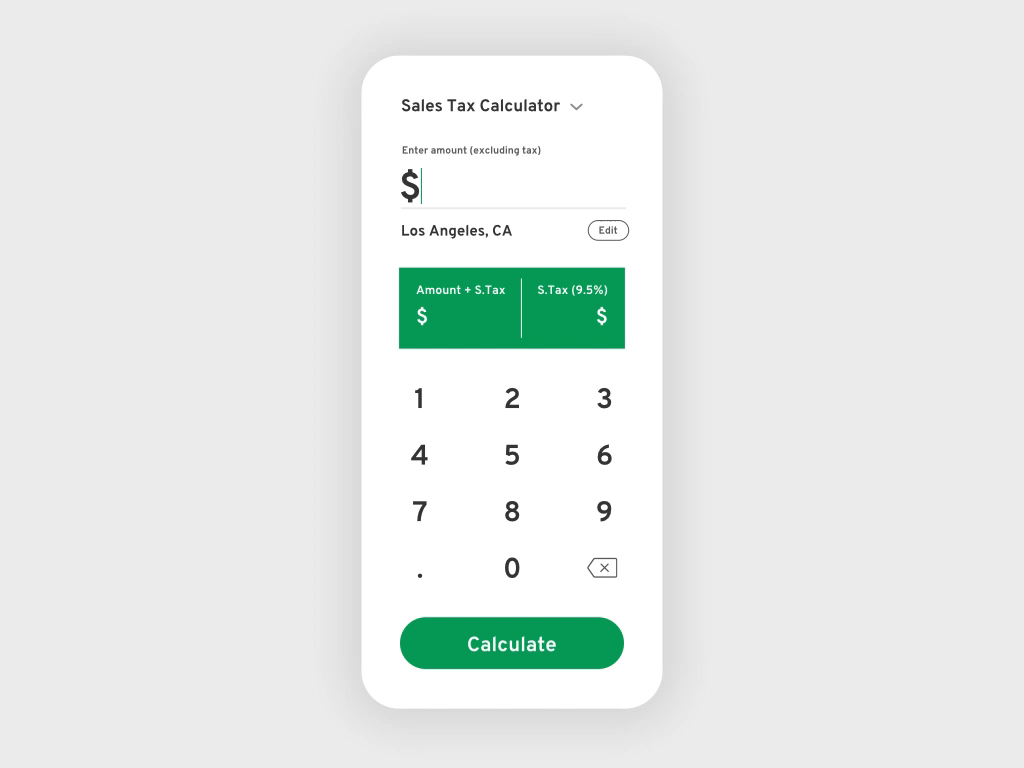

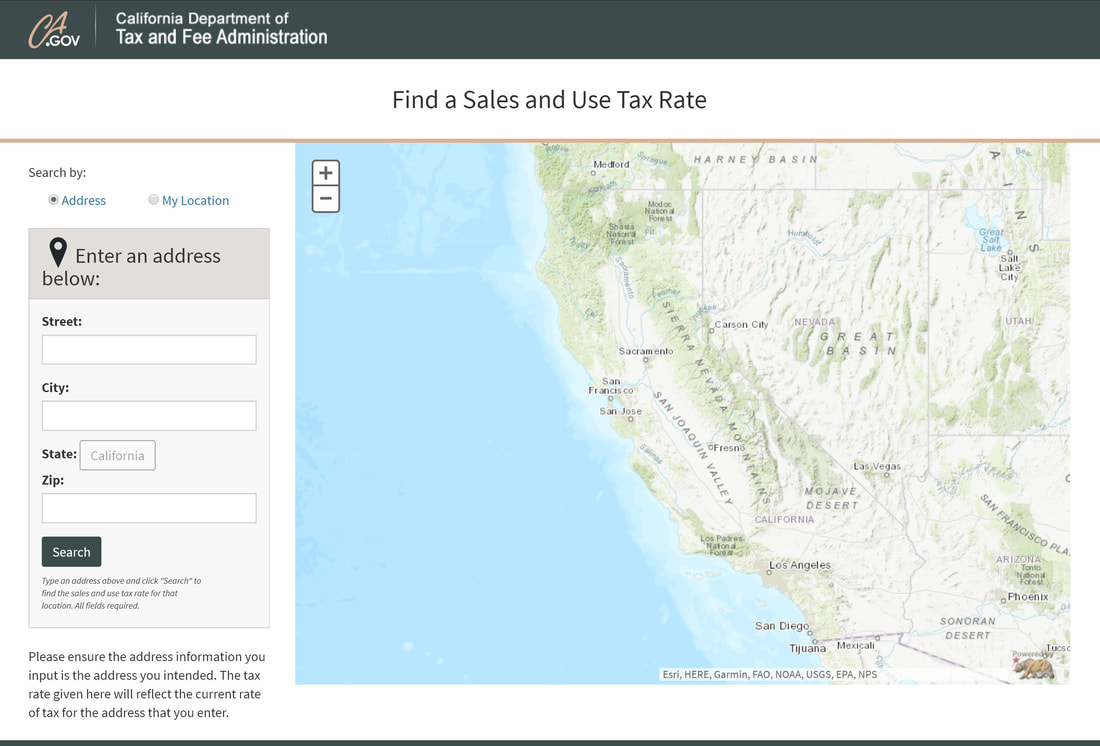

California sales tax calculator you can use our california sales tax calculatorto look up sales tax rates in california by address zip code. The combined rate used in this calculator 65 is the result of the californiastate rate 65. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

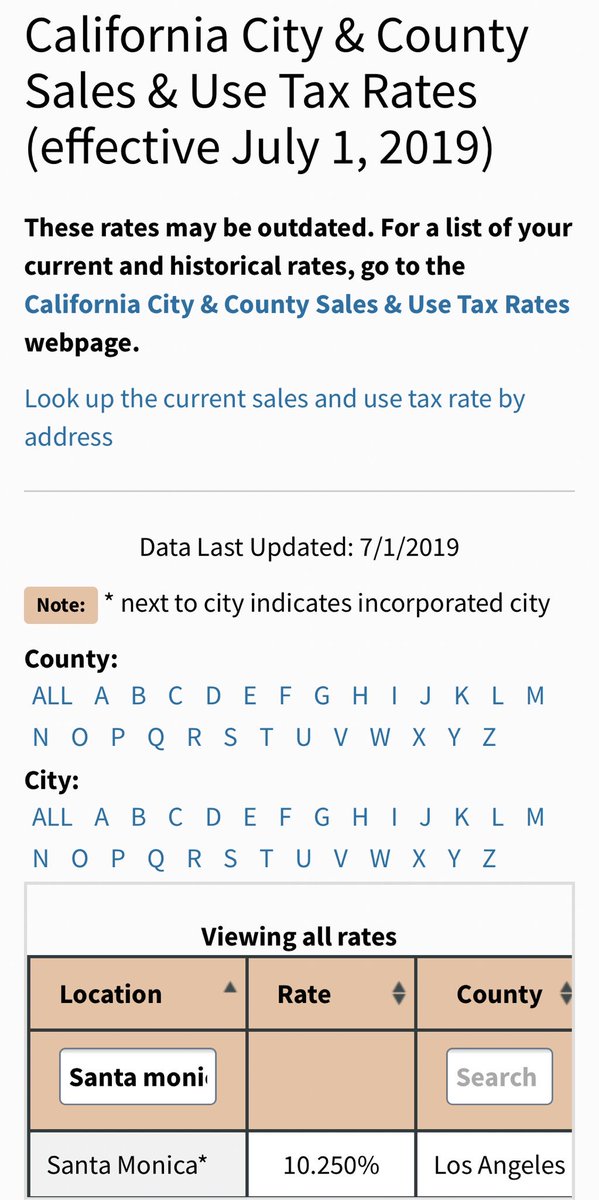

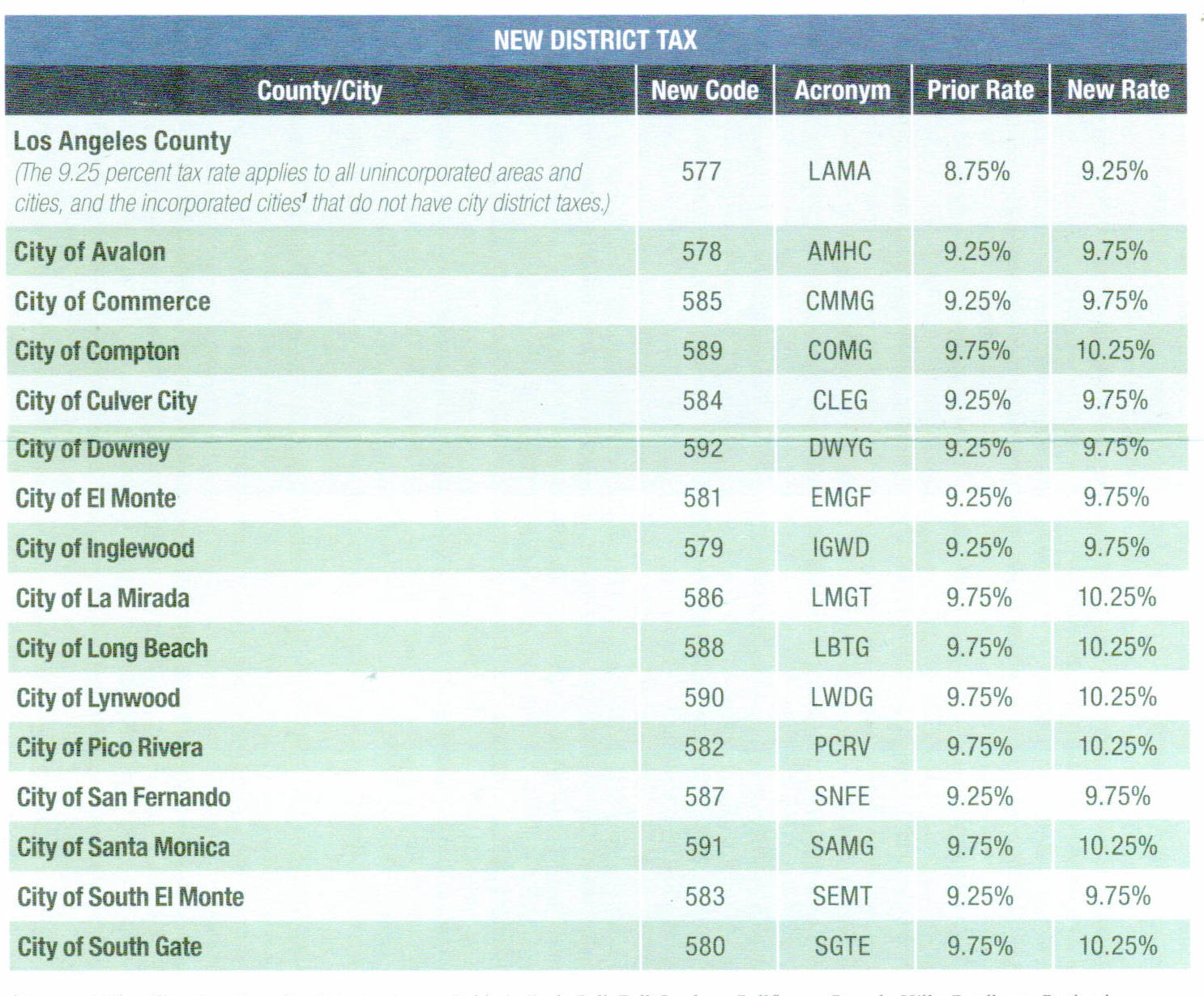

The 90033 los angeles california general sales tax rate is 95. California sales tax californias base sales tax is 725 highest in the country. For a list of your current and historical rates go to the california city county sales use tax rates webpage.

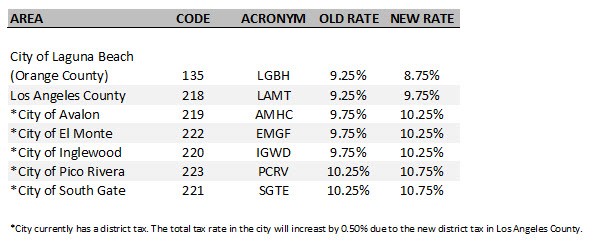

California city county sales use tax rates effective july 1 2020 these rates may be outdated. Look up the current sales and use tax rate by address. The combined rate used in this calculator 95 is the result of the californiastate rate 6 the 90033s county rate 025 and in some case special rate 325.

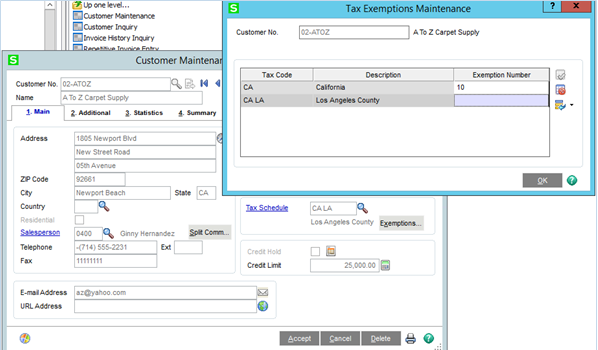

County of los angeles. The los angeles county sales tax rate is 025. The los angeles county sales tax calculator allows you to calculate the cost of a product s or service s in los angeles county california inclusive or exclusive of sales tax.

Before tax price sale tax rate and final or after tax price. The los angeles california general sales tax rate is 6. The sales tax calculator can compute any one of the following given inputs for the remaining two.

Los Angeles Tax Lawyer Gordon Law Financial Calculators Financial Personal Savings

www.pinterest.com

/california-state-taxes-amongst-the-highest-in-the-nation-3193244-finalv2-8a746a2ad14c4fba8d21382f812c7c76.png)